Peer-to-peer lending is a new investment instrument that is present in Indonesia. This type of investment, which is also known as P2P Lending, was born because of the development of digital technology. Because that’s where P2P Lending is included in Financial Technology (FinTech).

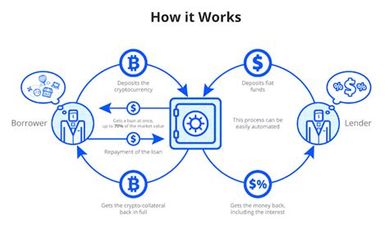

How does P2P Lending Works?

Peer-to-peer lending is a medium that brings together borrowers and lenders so that online lending and borrowing activities occur. For this reason, P2P Lending can be seen from two sides, both from the borrower and lender sides.

From the borrower or browser side, P2P Lending is an alternative lending platform. The borrower in question can be anyone depending on the focus of each company.

There is also P2P Lending which provides loans to people who need loans for productive purposes . For example, a browser is a micro-business entrepreneur, who needs capital for business.

you can read PEER-PEER In Wikipedia

Advantages of P2P Lending for Borrowers

As previously explained, P2P Lending is an alternative for micro-business entrepreneurs to develop their business. Here are some of the advantages of P2P Lending for Borrowers :

- Easier loan terms

- Faster process

- Helping the development of micro-business in Indonesia

Are you ready to invest with P2P Lending?

Before investing make sure you’re already addressing possible financial risks that may exist. That way, your investment can be smooth. Easy, you can register yourself for insurance online.

Besides being easy and affordable, you can get various types of protection that are useful to help you fight unexpected risks financially. For beginners, just choose life or health insurance that suits you. You will also feel safer and more comfortable investing.